N

NewsMaker

Administrator

- USD

- $40,998,899

- Gold

- G4,000

Fifty days after Inauguration Day, the stock market is registering its worst performance of a new Administration since President Obama’s first term in 2009.  Jittery investors have sold stocks at a record pace, following the implementation of President Trump’s tariffs on a wide range of countries including Canada, Mexico, China, and the European Union.

Jittery investors have sold stocks at a record pace, following the implementation of President Trump’s tariffs on a wide range of countries including Canada, Mexico, China, and the European Union.

While stocks crash, gold and silver roar higher. Gold just reached a new record high above $3,000 an ounce.

So what does this mean for your stock portfolio and the economy? Recession risks in the United States are rising fast. In a new Reuter’s survey, 95% of economists polled across Canada, the U.S. and Mexico said recession risks in their economies had increased as a result of the new tariff policy.

While the stock market tumbled, tangible assets like gold and silver have provided investors a safe haven amid market volatility and economic uncertainty.

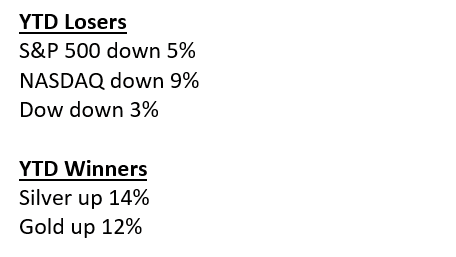

Performance since the start of 2025

The stock market is considered a leading indicator for the economy as it reflects investor sentiment and overall economic health. Worries for a meaningful slowdown in growth or even a recession are on the rise as the trade war continues to unfold on a daily basis.

In the latest move, President Trump threatened the European Union with a 200% tariff on imported wines and champagnes, if the bloc does not remove a duty on whiskey. The EU duties follow Trump’s 25% tariff on European imports of steel and aluminum.

The tit-for-tat tariffs have businesses and the stock market reeling. Businesses dislike uncertainty as it makes planning difficult. The risks for a deeper stock market correction are rising as reciprocal tariffs are expected to slow overall economic growth and hurt corporate profits. And, tariffs are expected to mean higher consumer prices on a range of imported goods, which could boost inflation.

What’s an investor to do? Investors can play defense in the current environment by increasing their allocation to precious metals. Gold is expected to continue to soar in the current environment with fresh investor demand fueled by geopolitical uncertainties, rising inflation expectations, and stock market volatility.

With gold hitting the $3,000 an ounce level, Goldman Sachs has now upped its 2025 gold target to $3,100 an ounce. And, Macquarie Group just issued a research note saying that gold’s safe-haven appeal could push prices to a record high of $3,500 an ounce in the third quarter of this year.

While the stock market tumbles and the economic uncertainty increases, there is safety and peace of mind in precious metals. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The post The Stock Market is A Leading Indicator: It’s Flashing Red appeared first on Blanchard and Company.

Read more

While stocks crash, gold and silver roar higher. Gold just reached a new record high above $3,000 an ounce.

So what does this mean for your stock portfolio and the economy? Recession risks in the United States are rising fast. In a new Reuter’s survey, 95% of economists polled across Canada, the U.S. and Mexico said recession risks in their economies had increased as a result of the new tariff policy.

While the stock market tumbled, tangible assets like gold and silver have provided investors a safe haven amid market volatility and economic uncertainty.

Performance since the start of 2025

The stock market is considered a leading indicator for the economy as it reflects investor sentiment and overall economic health. Worries for a meaningful slowdown in growth or even a recession are on the rise as the trade war continues to unfold on a daily basis.

In the latest move, President Trump threatened the European Union with a 200% tariff on imported wines and champagnes, if the bloc does not remove a duty on whiskey. The EU duties follow Trump’s 25% tariff on European imports of steel and aluminum.

The tit-for-tat tariffs have businesses and the stock market reeling. Businesses dislike uncertainty as it makes planning difficult. The risks for a deeper stock market correction are rising as reciprocal tariffs are expected to slow overall economic growth and hurt corporate profits. And, tariffs are expected to mean higher consumer prices on a range of imported goods, which could boost inflation.

What’s an investor to do? Investors can play defense in the current environment by increasing their allocation to precious metals. Gold is expected to continue to soar in the current environment with fresh investor demand fueled by geopolitical uncertainties, rising inflation expectations, and stock market volatility.

With gold hitting the $3,000 an ounce level, Goldman Sachs has now upped its 2025 gold target to $3,100 an ounce. And, Macquarie Group just issued a research note saying that gold’s safe-haven appeal could push prices to a record high of $3,500 an ounce in the third quarter of this year.

While the stock market tumbles and the economic uncertainty increases, there is safety and peace of mind in precious metals. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The post The Stock Market is A Leading Indicator: It’s Flashing Red appeared first on Blanchard and Company.

Read more